Payroll calculator 2021

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. For example if an employee makes 25 per hour and.

How To Calculate Payroll Taxes Methods Examples More

If you need more flexible and better payroll calculation such as generating EA Form automatically or adding allowance that does not contribute to PCB EPF or SOCSO you may.

. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Computes federal and state tax withholding. Our updated and free online salary tax calculator incorporates the changes announced in the Budget Speech.

Aren Payroll Aren Register Product Comparison Prices Whats New. The state tax year is also 12 months but it differs from state to state. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

It will confirm the deductions you include on your. Small Business Low-Priced Payroll Service. Starting as Low as 6Month.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. About the US Salary Calculator 202223. Then multiply that number by the total number of weeks in a year 52.

Heres a step-by-step guide to walk. 3 Months Free Trial. See how your refund take-home pay or tax due are affected by withholding amount.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. ICalculator provides the most comprehensive free online US salary calculator with detailed. Some states follow the federal tax.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Supports hourly salary income and multiple pay frequencies. Use this tool to.

2022 Federal Tax Tables. Estimate your federal income tax withholding. The maximum an employee will pay in 2022 is 911400.

3 Months Free Trial. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary. This free easy to use payroll calculator will calculate your take home pay.

Starting as Low as 6Month. View what your tax saving or liability will be in the 20222023 tax year. Free salary hourly and more paycheck calculators.

Multiply the hourly wage by the number of hours worked per week. 2021 Federal Tax Tables. Small Business Low-Priced Payroll Service.

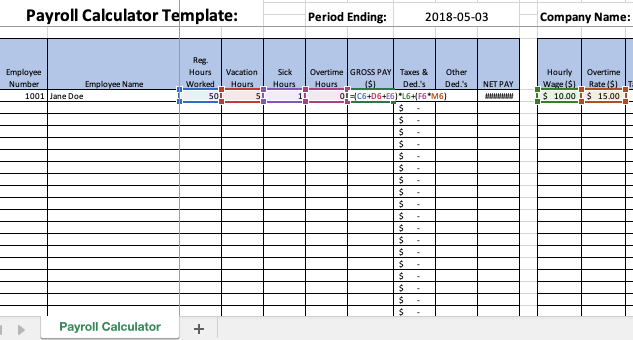

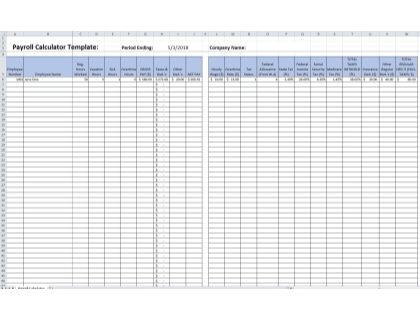

Payroll Calculator With Pay Stubs For Excel

How To Calculate Payroll Taxes Methods Examples More

Calculation Of Federal Employment Taxes Payroll Services

Calculation Of Federal Employment Taxes Payroll Services

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator With Pay Stubs For Excel

Excel Payroll Formulas Includes Free Excel Payroll Template

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Payroll Template Free Employee Payroll Template For Excel

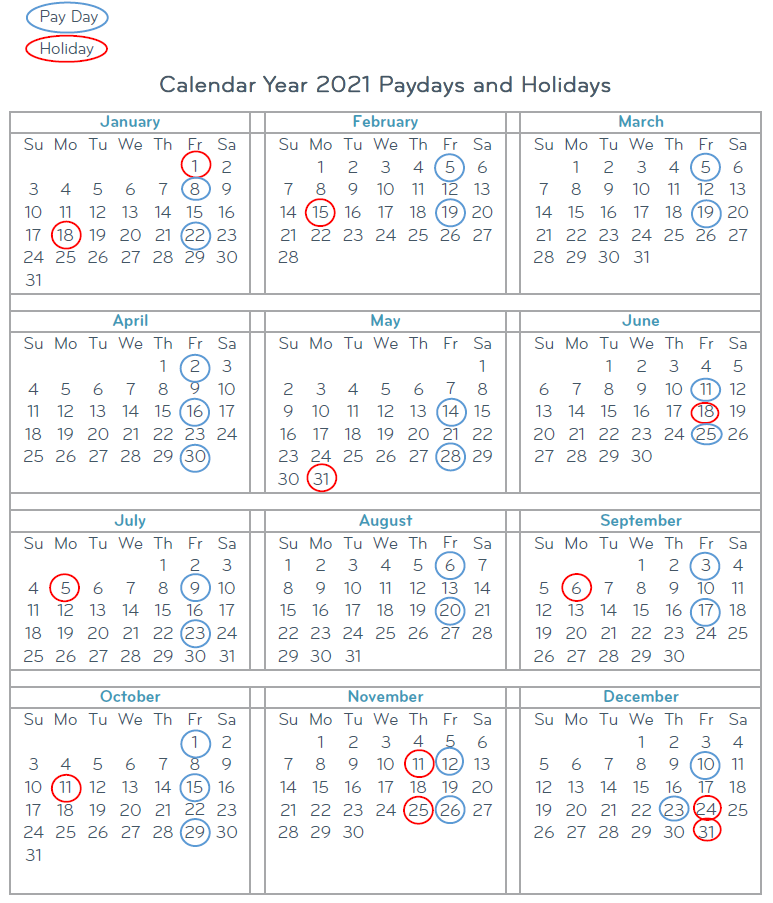

Payroll Calendar 2021 Paydays And Holidays

Excel Payroll Formulas Includes Free Excel Payroll Template

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

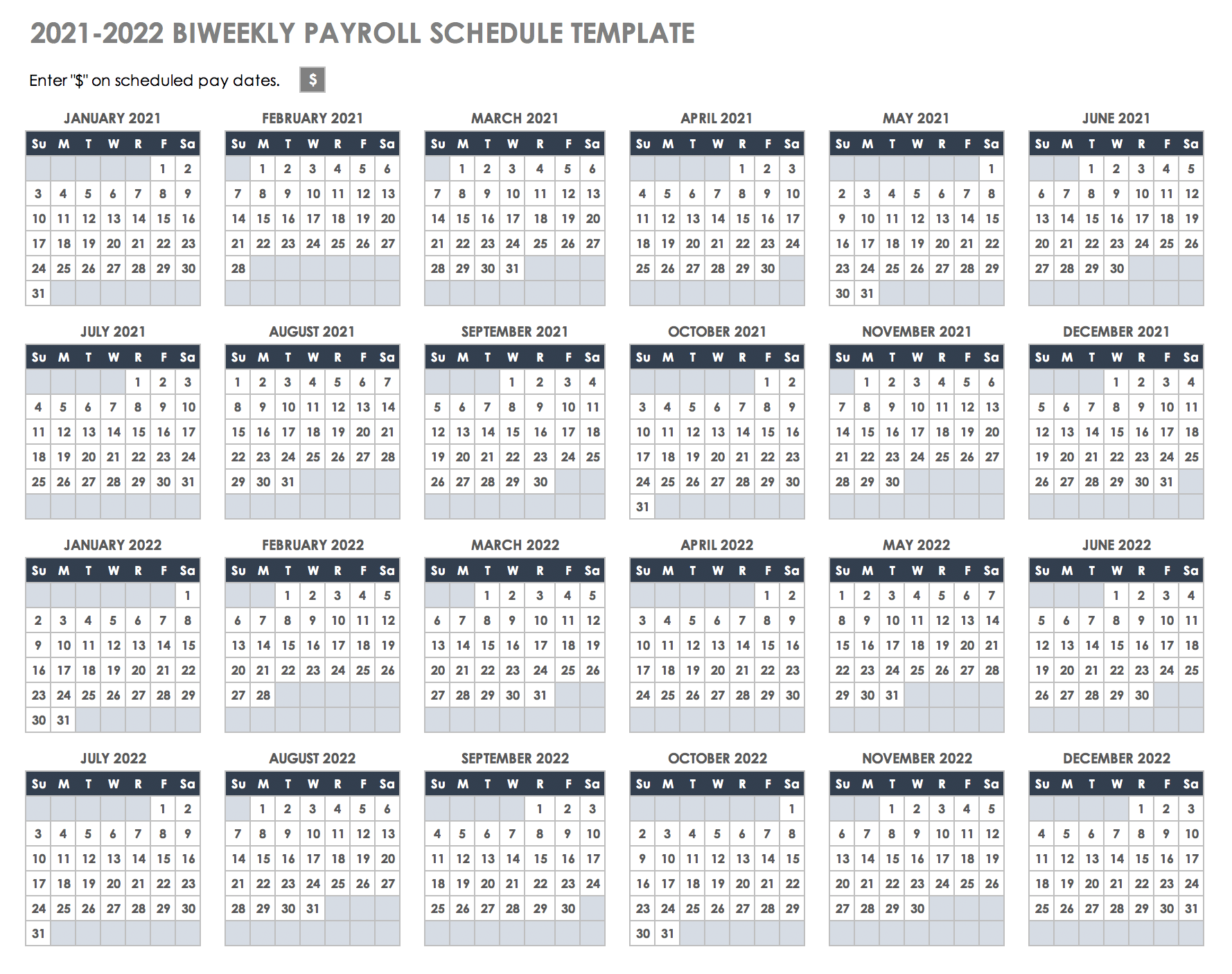

15 Free Payroll Templates Smartsheet